Iron & Steel

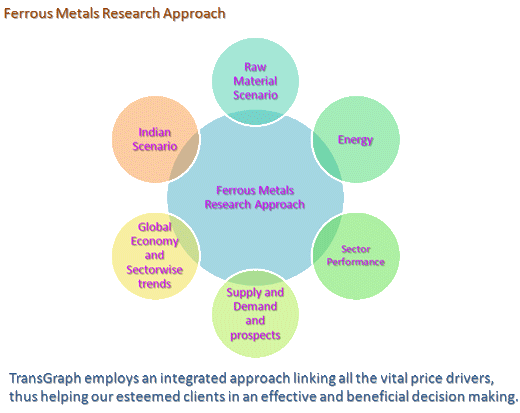

We track specified categories of ferrous metals majorly in to steel and steel making

raw materials like Iron ore, Met coke, thermal coal. Steel having its widest applications

and is available in various forms like Flats, Longs, Tubular products etc. We at

TransGraph actively track Hot Rolled Coils, Cold Rolled Coils and Long Products

like TMT bars. Apart from benchmark markets, we also give price forecast on physical

markets for specified mills in India.

We have our clients in construction industry, automotive industry, galvanizing industry

etc. deriving benefits by way of valuable market intelligence and precise price

outlook. Our price forecast accuracy is in the range of 85% and our clients have

been able to save 4% on their procurement spend.

Reports

|

|

|

|||

|

|||||

|

|

|||

|

||||

Explore more...

- Commodity Research

MTMT | Customized Reports | Free Trial -

Base Metals

Reports | Features | Audit -

Crude Oil & Bio Diesel

Reports | Features -

Currency

Reports | Features | Audit -

Edible Oils & Oilseeds

Reports | Features | Audit -

Grains & Pulses

Reports | Features | Audit -

Iron & Steel

Reports | Features | Audit -

Lauric Oils and Oleochemicals

Reports | Features | Audit -

Mango

Reports | Features | Audit -

Milk

Reports | Features | Audit -

Natural Rubber

Reports | Features | Audit -

Paper & Paper Boards

Reports | Features | Audit -

Polymers

Reports | Features | Audit -

Sugar & Molasses

Reports | Features | Audit - Resources Center

Brochures | Case Studies | Conference Papers - Schedule an Analyst Interaction

- Promotions

Testimonials

“ I am writing to extend my thanks for the research and price forecasting services provided to us on a daily basis by Transgraph. The reports and information whether they are emailed to us daily or sourced via your website portal, are a consistent and reliable source of quality information. Our industry is one where information and its dissemination can help in differentiating between suppliers."

- Scott Yarwood, Sr. Regional Sales Manager, ADM Trading (UK) Ltd.

“ This is to state our appreciation for Transgraph for continuously delivering on its mandate to provide updated and insightful consulting services in the area of commodities and ingredients. I would also like to thank your team that is always in touch with buyers and feeds in relevant information that has been many times useful in decision making. In nutshell, the engagement with Transgraph has been enriching."

- V. Sridhar, Sector Manager, Commodities & Ingredients, Cadbury India Ltd.

“ By helping simulate the risk scenarios beforehand, TransRisk has added immense value to our trading decision making process at the operating level. The scenarios are comprehensive because one is able to view the basis and rollover risks associated with the hedged positions too. TransRisk also serves as good Dashboard for the top management, as it gives exposures, P&L, associated risk, limits all at one place.”

- S Sivakumar, CEO, Agri Business, ITC Limited

“ At risk framework and imputed risk model of TransRisk are definitely forward looking

and will enable us to move away from ‘post mortem’ approach. We can

take a business decision of pricing our contracts or purchasing in advance after

factoring in a quantifiable and acceptable risk instead of trying to find reasons

for the breach of limits."

"A flexible and scalable business intelligence that gives exposures, P&L,

associated risk, limits all at one place and this decision support system can be

integrated with our existing ERP and will avoid duplication of data entry.”

- Jude Magima, ED – Sourcing and Supply Chain, Dabur India Limited

“ Transgraph has showcased that ‘Risk Management’ is an excellent tool which will help any sourcing organization to deliver in any and even during challenging business scenario. They have succeeded in creating a deeper, specific and relevant input to the automotive sector. Highly recommended, the course was extremely detailed but the faculty made it so easy to understand - Top marks.”

- S.R. Rajan, Vice President-Commercial, TVS Srichakra Limited.

Features

| Features | Daily Price Outlook & Strategy | Weekly Price Outlook & Strategy | Monthly Long term outlook | |||

|

Coverage | Indian Steel | HR Coils (Steel Flats) | Indian TMT (Steel Longs) | Iron ore, Coking coal, met coke | |

| Fundamental summary | Critical fundamental Factors; Fundamental outlook Index | Critical fundamental Factors; Fundamental outlook Index | Critical fundamental Factors; Fundamental outlook Index | Supply & Demand Forecasts; Inventory; Sentiment index; Currency impact; Recent developments | ||

| Technical summary | Technical analysis summary | Technical analysis summary | Technical analysis summary | Technical Outlook | ||

| Price Direction | NCDEX: Price Direction Forecast | Ludhiana Spot: Price Direction Forecast | Mumbai Spot: Price Direction Forecast | Mild Steel Ingots, HR Coils, TMT Bar, CR Coils : Price Direction Forecast | ||

| Price range forecast | Price Range: 5 day & 10 day forecast | Price Range: 2 week, 1 & 2 months forecast | Price Range: 2 week, 1 & 2 months forecast | Price Range: 2 months forecast | ||

| Strategy review | Review of previous strategy | Review of previous strategy | Review of previous strategy | Not Applicable (NA) | ||

| Latest Strategy | NCDEX: Trading strategy | Ludhiana Spot: Generic procurement strategy | Mumbai Spot: Generic procurement strategy | NA | ||

| Performance Audit |

NCDEX Strike Rate; NP/GP ratio |

Ludhiana Spot Strike Rate; % savings |

Mumbai Spot Strike Rate; % savings |

NA | ||

| Fundamental analysis | Yester session market review | Comprehensive fundamental analysis Global Economy analysis | Comprehensive fundamental analysisGlobal Economy analysis | Iron ore, Coking coal, met coke dynamics, consumption patterns, import parities, Steel dynamics:Indian, Chinese, Crude Steel; | ||

| Technical outlook | Detailed technical analysis and outlook on NCDEX for short term | Detailed technical analysis and outlook on Ludhiana Spot for medium term | Detailed technical analysis and outlook on Mumbai Spot for medium term | Elliott waves | ||

| Risk Parameters | Volatility & VaR trends | Volatility & VaR trends | ||||

| Calendar | Key Economic & Fundamental Data | Key Economic & Fundamental Data | Key Economic & Fundamental Data | NA | ||

| Mini Charts | Various must track data trends | Various must track data trends | Various must track data trends | NA | ||

| Facts & Figures | Most important market data | Most important market data | Most important market data | NA | ||

| Other | Not Applicable (NA) | CFTC COT analysis | CFTC COT analysis | CFTC COT analysis | ||

Audit

| Period | Strike Rate % | NP/GP % | Procurement Savings % | |||||

| 2012 YTD | 2007-12 YTD | 2012 YTD | 2007-12 YTD | 2012 YTD | 2007-12 YTD | |||

| Daily Copper Price Outlook & Strategy | 60% | 61% | 72% | 55% | NA | |||

| Weekly Steel Flats Price Outlook & Strategy | 60% | 77% | NA | 0.12% | 4.69% | |||

| Weekly Steel Longs Price Outlook & Strategy | 80% | 83% | NA | 0.3% | 3.99% | |||

|

YTD: Year Till Date

Strike Rate %: Daily: Percentage of number of strategies made profit. Weekly: Percentage of number of months bettered the market average NP/GP %: {(Gross Profit - Gross Loss) / (Gross Profit)}X100 Procurement Savings %: {(Market average - TransGraph purchase price) / (Market average)}X100 |

||||||||