From Risk to Reach:

How China Is Expanding Its Global Export Footprint

China is steadily reshaping its export strategy by reducing its dependence on long-standing markets such as the US and putting more weight on ASEAN, Europe, Africa, Latin America, and other emerging economies. This shift is supported by an ongoing upgrade in manufacturing and broader efforts to make supply chains more adaptable.

Recent Policy Shifts

Beijing has been encouraging provinces and companies to play a more active role in supporting trade expansion. Leaders like Vice-Premier He Lifeng are pushing initiatives that prioritize cross-border e-commerce, overseas warehouse networks, and wider market outreach. The goal is to cushion exporters from rising global uncertainty and persistent tensions with the US.

Export Market Trends in 2025

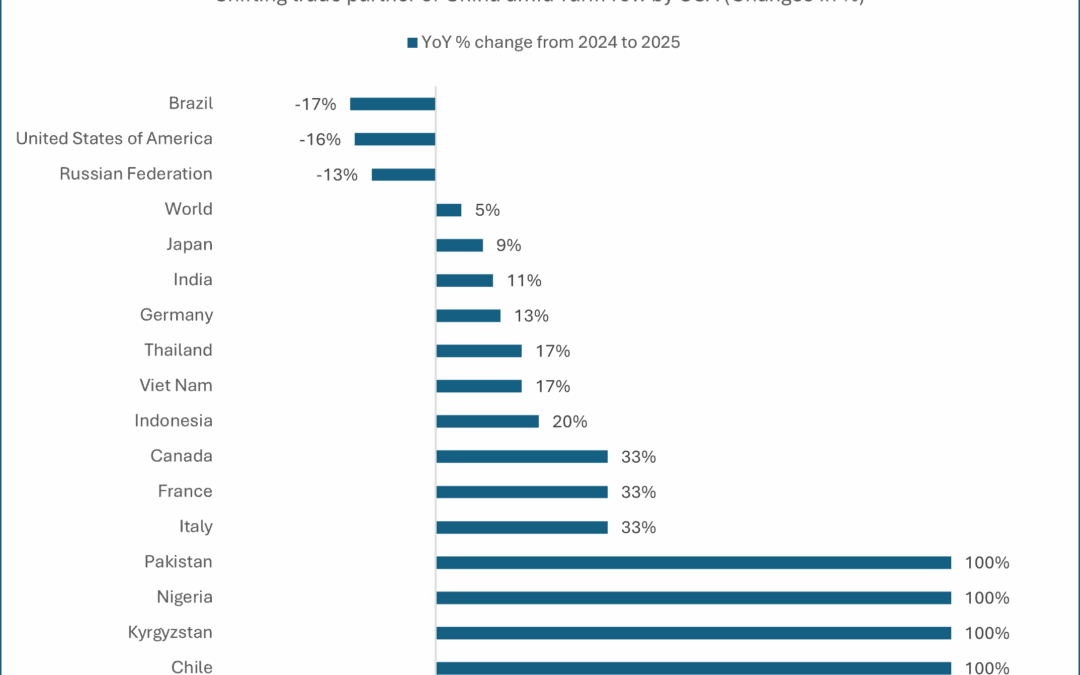

Exports to major economies are weakening.

Shipments to Brazil dropped 17 percent, the United States 16 percent, and Russia 13 percent. These declines line up with higher tariffs and a tougher geopolitical backdrop.

Steady growth in China’s traditional partners.

Global exports rose 5 percent overall. Countries such as Japan (+9 percent), India (+11 percent), Germany (+13 percent), Thailand (+17 percent), Vietnam (+17 percent), and Indonesia (+20 percent) saw solid but moderate gains, suggesting China is leaning more on Asian markets to offset losses elsewhere.

Stronger momentum in smaller Developed markets.

Exports to Canada, France, and Italy climbed 33 percent each, showing that China is successfully widening its presence in more stable and less politically exposed markets.

Rapid expansion into non-traditional destinations.

Trade with Pakistan, Nigeria, Kyrgyzstan, and Chile doubled, reflecting China’s deeper push into emerging economies that present fewer tariff risks and greater openness.

Strategic Diversification Measures

China’s diversification drive is being reinforced by several key strategies:

- The “China Plus One” approach, where firms build regional production bases abroad to reduce exposure to single-market risks.

- Investments in supply-chain resilience, including overseas manufacturing and bonded logistics to cut tariff pressure and improve global responsiveness.

- Government support through export credit guarantees, VAT rebates, extended RCEP benefits, and targeted incentives for industries like semiconductors and new-energy vehicles.

Impact and Outlook

These policies have helped China stabilize its export performance despite steep US tariffs, now averaging more than 50 percent and covering almost all categories. More exporters are billing in RMB, signing currency-swap deals, and relocating production to fast-growing regions. This gradual realignment is positioning China to be less exposed to global shocks while opening new long-term growth channels.

China is increasingly redirecting exports from the US to faster-growing regions like ASEAN, Latin America, and Africa. This helps offset weak demand from developed economies but creates greater dependence on emerging markets. These countries risk being crowded out by China’s dominant production, and any volatility in China’s domestic market could lead to serious disruptions or economic pressures for them.

China’s diversification push is likely to continue shaping global trade, strengthening its economic buffer, and creating new momentum through emerging markets and advanced manufacturing sectors.