Industries

Industries We Serve

At TransGraph Consulting, we provide market intelligence, price consulting, and risk management solutions to a wide range of industries. Our expertise helps businesses navigate price volatility, optimize procurement, and make informed decisions in dynamic commodity markets.

Food Processors

- Edible oils, sugar, grains, dairy & packaging materials – TransGraph tracks major oils (palm, soy, rapeseed, sunflower) across the veg-oils complex for FMCG and food-production clients; it monitors sugar markets in India, Brazil, China and other major regions; and it covers grains such as wheat, barley and maize for FMCG, biscuits and food segments. The team also provides expert analysis on dairy products such as milk, fat and skim-milk powder (SMP) for major FMCG firms. Packaging inputs are covered through research on polymers (PP, PE, PET) and paper & paper boards (kraft paper and duplex board) used in food packaging.

- Procurement strategies & price risk management – clients receive daily and weekly price outlooks and hedging strategies across edible oils, sugar, grains, dairy and packaging materials. These strategies help optimise purchase timing and manage budget volatility, leveraging TransGraph’s reputation as an authoritative source of commodity intelligence.

- Demand-supply analytics & policy monitoring – analysts continuously monitor global supply/demand trends, inventories and government interventions affecting sugars, grains, oils and dairy. This includes tracking weather, crop yields, trade flows and legislative developments across major producing regions.

- Cost optimisation & procurement efficiency – insights into alternative feedstocks, by-product values and packaging innovations help reduce costs for packaged foods, beverages and personal-care lines. Dedicated teams track price movements and provide market intelligence on polymers, paper and board, adding “remarkable value to procurement efficiencies” for FMCG clients.

Who We Work With: Food and beverage brands, packaged-food companies, personal-care product manufacturers and quick-service restaurants (QSRs), as well as other FMCG and food-production clients.

Plantations

- TransGraph’s commodity research covers crops such as Palm, Natural rubber, Cocoa, Coffee and sugar and other plantation crops; they help clients who rely on these commodities to protect profits and manage procurement.

- Procurement strategies & price risk management; customised buy-side and sell-side hedging models help estates and processors manage volatility and optimize sales.

- Yield & crop-health analytics; supply-demand modelling and field-level intelligence support crop planning and harvesting decisions.

- Cost optimisation & sustainability; advisory services on input costs (fertiliser, labour, logistics) and sustainability initiatives help plantations remain competitive.

Who We Work With:Palm Plantations, Natural-rubber estates, sugar plantations, Cocoa and coffee estates, agro-industrial groups and latex processors.

Personal Care

- Edible oils & oleochemicals plus polymers – TransGraph tracks lauric oils (crude palm-kernel oil, palm fatty-acid distillate and coconut oil) used in shampoos, conditioners and soaps; it also tracks polymer grades like polypropylene (PP), polyethene (PE) and PET used in packaging.

- Procurement strategies & price risk management – clients get market intelligence and hedging guidance to manage ingredient and packaging costs.

- Demand-supply analytics – analysis of global supply/demand for lauric oils and polymers, biodiesel demand, weather, and policy factors drive price forecasts.

- Cost optimization for personal-care lines – benchmarking packaging formats, assessing alternative feedstocks and designing vendor strategies helps control cost.

Who We Work With:Personal-care brands, cosmetics manufacturers, soap/detergent producers and packaging companies.

Crushing & Refining

- Edible oils & oilseeds (palm, soy, rapeseed, sunflower); TransGraph specialises in research across the entire veg-oils complex.

- Procurement strategies & price risk management – crushers and refiners receive price forecasts, spread analysis and hedging strategies to manage raw-material and product prices.

- Demand-supply analytics – supply/demand tracking of major oilseed markets, weather, government policies, and acreage informs purchasing decisions.

- Margin optimisation – analysis of crush margins, refining yields and logistics identifies cost-saving opportunities.

Who We Work With: Oilseed-crushing plants, edible-oil refiners, biodiesel producers, oleochemical companies and integrated agribusinesses.

Feed

- Feed grains & oilseed meals (maize, wheat, barley, soybean meal) and dairy inputs; TransGraph tracks major grains such as wheat, barley and maize and advises on dairy products like milk, fat and skim-milk powder.

- Procurement strategies & price risk management; price outlooks and hedging strategies help feed mills and livestock producers manage ingredient costs.

- Demand-supply analytics; models incorporate crop yields, government policies, animal-feed demand and international trade.

- Cost optimisation & formulation support; by comparing ingredient blends and monitoring by-product values, the team identifies savings while maintaining nutrition.

Who We Work With: Feed millers, poultry and livestock integrators, aquaculture companies, animal-nutrition firms and dairy operations.

Who We Work With: Construction, industrial machinery, and polymer-based manufacturing industries.

Breweries & Distilleries

- Sugar, molasses and brewing grains – India is a major sugar producer; TransGraph tracks sugar and molasses markets across key regions (India, Brazil, China, etc.), providing insights for distillers and brewers.

- Procurement strategies & price risk management; daily and weekly price outlooks for sugar, molasses and grains support budgeting and hedging for beverage and ethanol production.

- Demand-supply analytics; analysis of crop production, government quotas, ethanol policy and global trade flows informs procurement decisions.

- Cost optimisation & margin management; guidance on sourcing, storage and by-product utilisation helps breweries/distilleries preserve margins.

Who We Work With: Breweries, distilleries, beverage companies, molasses-based ethanol producers and maltsters.

Trading & Investments

- Multi-commodity coverage; TransGraph provides research and price forecasts across oils & oilseeds, base metals, grains, softs/plantations, crude oil and currencies.

- Hedging & risk-management strategies; we design hedging policies, VaR-based frameworks and risk dashboards for trading desks and investment portfolios.

- Market intelligence & trade advisory; services range from supply-demand analytics to fundamental/technical modelling and macro-economic insights to aid trading decisions.

- Portfolio and investment optimisation; analysis of cross-commodity correlations, spreads and carry trades assists funds in allocating capital and managing exposures.

Who We Work With: Commodity traders, hedge funds, investment arms of manufacturing firms, commodity exchanges, banks and other financial institutions.

Automotive

- Steel, aluminium, copper, rubber and polymers; TransGraph tracks steel products (hot-rolled coils, cold-rolled coils, long products), base metals like steel, copper, PGM and aluminium, natural rubber and polymers used in automotive components.

- Procurement strategies & price risk management; price forecasts and hedging strategies help OEMs manage metal and rubber inputs and protect margins.

- Demand-supply analytics; monitoring of global steel and base-metal markets, automotive demand cycles and tyre-rubber fundamentals informs sourcing decisions.

- Cost optimisation & just-in-time procurement – support includes budgeting, vendor negotiations, inventory planning and evaluating alternative materials.

Who We Work With: Automakers, auto-component manufacturers, tyre producers, battery manufacturers and ancillary suppliers.

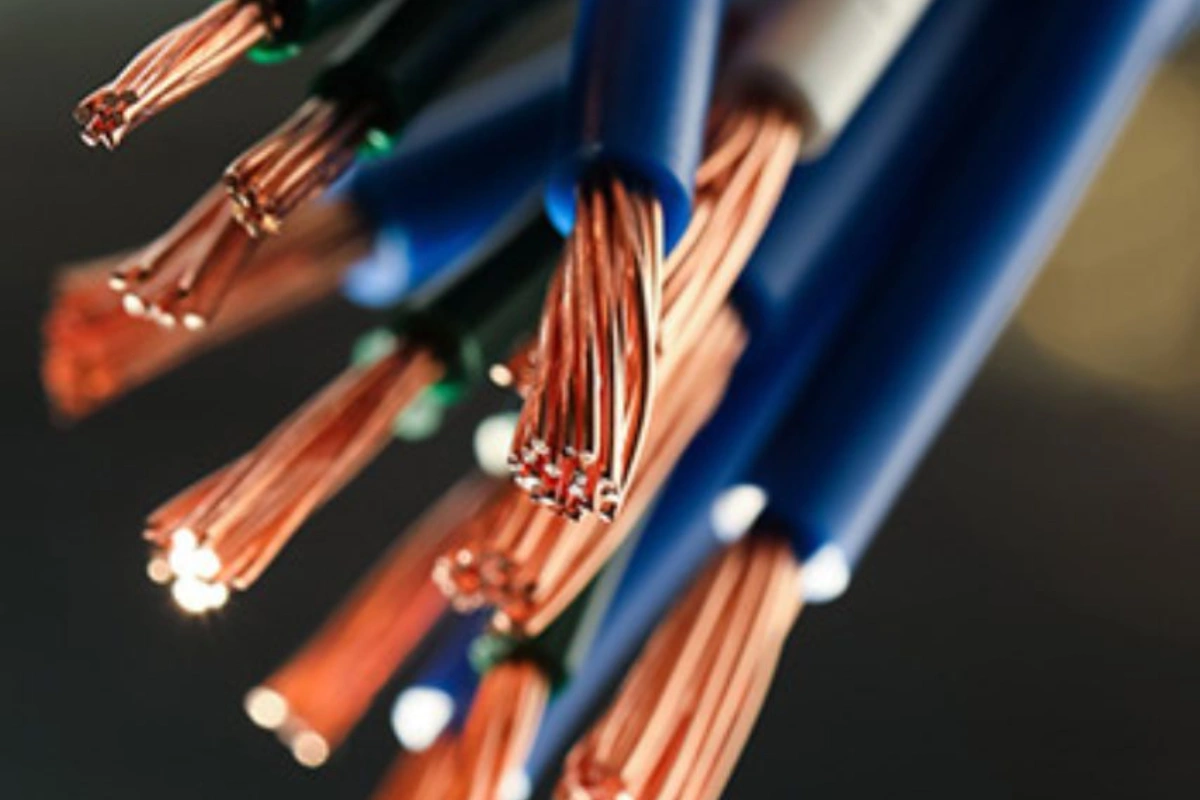

Cables & Wires

- Copper, aluminium, lead & polymer insulation; TransGraph delivers research and price outlooks for copper, aluminium, zinc and lead and tracks polymers like PP, PE and PET used in cable insulation.

- Procurement strategies & price risk management; hedging guidance and market intelligence help cable and wire manufacturers manage volatile metal prices.

- Demand-supply analytics; analysis of global smelting capacity, scrap flows, energy prices and infrastructure demand informs procurement.

- Cost optimisation & scrap management; insights on scrap recycling, contract structures and inventory levels reduce procurement costs and support sustainability.

Who We Work With: Cable and wire manufacturers, electrical equipment producers, power utilities and telecom-infrastructure firms.

Oil & Gas

- Crude oil, refined products & biodiesel feedstocks; crude oil and its derivatives are central to all sectors; TransGraph tracks crude oil and bio-diesel markets with dedicated teams.

- Procurement strategies & price risk management; daily, weekly and monthly price outlooks and hedging models support risk management for crude and refined products.

- Demand-supply analytics; monitoring of global supply/demand, OPEC actions, geopolitics, and renewable energy trends informs procurement and trading.

- Cost optimisation & margin management; analysis of crack spreads, refinery margins, feedstock alternatives and logistics helps optimise profitability.

Who We Work With: Upstream oil producers, refineries, petrochemical plants, power generators and industrial fuel consumers.

Mining & Manufacturing

- Base & ferrous metals (copper, aluminium, zinc, lead, iron ore, steel); TransGraph provides price research, feasibility studies, market intelligence and risk management across base metals and tracks steel and its raw materials (iron ore, met coke, thermal coal).

- Procurement strategies & price risk management; price forecasts and hedging strategies support both producers and consumers in managing metal price volatility.

- Demand-supply analytics; supply/demand modelling, inventory tracking, and policy analysis for metals and minerals inform investment and production planning.

- Cost optimisation & feasibility studies; value-chain analysis, feasibility studies, and market research help evaluate capital projects and operational efficiency.

Who We Work With: Mining companies, smelters, metal producers, heavy-equipment manufacturers, construction-material manufacturers and industrial manufacturers.

Roles We Serve

Our solutions cater to key stakeholders across industries, helping them enhance decision-making, manage risks, and optimize procurement.

Management & Business Leaders – CXOs

- High-level strategic insights for long-term business growth – With nearly two decades of price-consulting experience across oils & oilseeds, base metals, grains, softs, plantations and currencies, TransGraph delivers commodity intelligence with an average price-forecast accuracy of 75% and procurement savings of 2-4%. Its research approach, “Mapping the Market Thought,” integrates fundamental, technical, statistical and economic analysis, enabling CXOs to align long-term growth plans with commodity trends.

- Commodity-driven financial planning & budgeting – TransGraph’s deliverables span research reports, hedge modelling, drafting of risk-management policies and customised procurement/trading/hedging strategies. These services help leadership teams develop annual budgets and commodity-driven financial plans that anticipate market volatility and optimise procurement.

- Market intelligence for executive decision-making – The firm provides market intelligence, value-chain analysis, feasibility studies and evaluation/impact assessments, supporting executives in decisions such as expansion, capital allocation and supply-chain diversification across manufacturing, FMCG and other sectors.

- Risk-mitigation strategies for business stability – TransGraph’s risk consulting service benchmarks existing practices, drafts risk-management guidelines and develops customised hedge frameworks and models with ongoing support. Its TransRisk software offers a “strategy cockpit” and system-generated alerts on exposures, P&L and risk, enabling leadership to monitor enterprise-wide risks and respond quickly.

Applicable Industries: FMCG, manufacturing, energy, pharmaceuticals and government advisory.

Procurement/Sourcing & Supply Chain/Logistics Managers

- Commodity price forecasting for better buying decisions – Long-term price forecasts help procurement teams time purchases and design procurement budgets; case studies show TransGraph provided long-term forecasts and regular support to plan and time purchases, leading to raw-material shipments well below budget and savings up to 11.5%.

- Procurement strategies to mitigate cost risks – For a large automobile firm TransGraph evaluated alternative procurement strategies, established a commodity risk-management committee and implemented price-outlook-based component pricing, delivering savings on substantial commodity exposures. Custom hedge frameworks cover when, where and how much to hedge across physical and derivative trades, helping managers manage budget volatility.

- Supplier benchmarking & negotiation support – In a confectionery case study, TransGraph provided a price-negotiating framework, identified potential suppliers and performed value-chain analysis; by understanding stages of value addition, the client achieved savings of around 5% and significantly reduced budgetary overshoot.

- Training & implementation assistance – Risk consulting offers guidance in establishing in-house risk committees, knowledge-sharing training and support to measure and monitor hedge performance, ensuring supply-chain teams build procurement and risk-management capabilities.

Applicable Industries: FMCG, manufacturing, edible-oils, retail and pharmaceuticals.

Risk Officers

- Price risk assessment for commodities & global markets – TransGraph performs risk profiling, risk node mapping and risk ranking for commodities and measures risk using Value-at-Risk (VaR) frameworks (Monte-Carlo, historical and parametric. These tools help risk officers quantify exposures and understand risk-return characteristics.

- Hedging strategies & market-volatility mitigation – The firm develops customised hedge frameworks that address when to hedge, where to hedge and how much to hedge and supports diverse exposures (physical, derivative, basis/spread trades). Risk-management policies include committee structures, risk philosophies, limits and alerts, enabling comprehensive hedging.

- Risk monitoring through data-driven dashboards – TransRisk provides exposure analysis, decomposes risk at the position level and simulates stress-test scenarios. Its reporting framework and OLAP tool allow preparation of customised reports, while the strategy cockpit and alerts/limits features deliver a bird’s-eye view of exposures, P&L and risk.

- Implementation & governance support – Dedicated account managers offer knowledge-sharing training, help set up risk committees and provide ongoing hedge-strategy reports and performance monitoring, ensuring robust risk governance.

Applicable Industries: Financial services, energy, automobiles and manufacturing.

Financial Analysts & Treasury

- Real-time commodity price analysis & trading strategies – TransGraph’s price consulting covers oils & oilseeds, base metals, grains & pulses, softs & plantations and crude & currencies, with an average forecasting accuracy of 75%. This broad coverage and accuracy enable analysts to identify trading opportunities and support daily treasury operations.

- Technical & fundamental market-outlook reports – The company’s “Mapping the Market Thought” approach combines fundamental, technical, statistical and economic analysis. New TransRisk features allow users to perform technical analysis with configurable indicators and oscillators, enhancing on-the-fly market diagnostics.

- Customized risk models for investment decision-making – TransRisk measures risk via VaR (Monte-Carlo, historical and variance-covariance methods), performs back-testing of positions with configurable VaR methods and offers risk-return analysis that evaluates distributions (mean, standard deviation, skewness, kurtosis). Analysts can build valuation frameworks and turn off complex instruments via modular settings.

- Advanced simulation & performance tools – The platform includes risk simulation for stress-testing and “what-if” scenarios and can simulate portfolios up to 100,000 times for detailed risk assessment, supporting sophisticated investment analysis.

Applicable Industries: Hedge funds, commodity-trading firms, investment firms and government bodies.

Traders & Investors

- Multi-commodity research & price forecasts – TransGraph covers a wide range of commodities (oils & oilseeds, base metals, grains & pulses, softs & plantations, crude & currencies). Its price-forecasting approach, with 75% average accuracy and 2-4% procurement savings, helps traders and investors time markets and identify profitable trades.

- Hedging & risk-management strategies – Risk consulting develops customised hedge models and frameworks, while TransRisk calculates net exposures, mark-to-market P&L and VaR across the organisation. These tools support both speculative and hedged trading strategies and enable traders to manage positions effectively.

- Market intelligence & trading advisory – TransGraph’s business consulting notes that commodities represent the fastest-growing markets and provide huge opportunities for trading and investing; with a decade of analysing over 30 commodities through bull and bear cycles, the firm acts as a one-stop source for trading/investment insight. Additional services include value chain analysis, demand studies and feasibility assessment.

- Integrated trading & risk-management solutions<,/b> – Integration of TransRisk with the ContraXcentral trading system provides a 360-degree view of operations, maximises operational efficiency and optimises returns by quantifying risks using VaR, implementing hedge models and simulating scenarios. Users gain end-to-end transaction management and decision-making at transgraph.com.

- Portfolio & investment optimisation – TransRisk’s risk-return analysis and cross-commodity correlation tools transgraph.com, along with exotic-derivative valuation and back-testing features transgraph.com, assist investors in evaluating portfolios and allocating capital across commodities and instruments.

Applicable Industries: Commodity traders, hedge funds, investment arms of manufacturing firms, commodity exchanges, banks and other financial institutions.