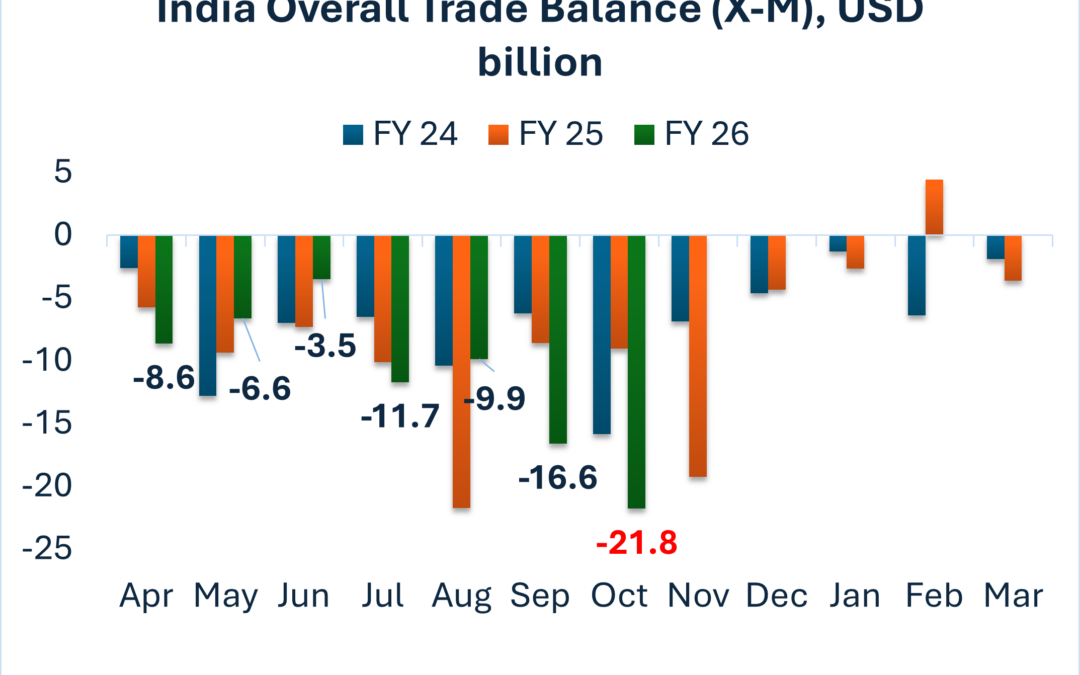

India External Accounts – Trade Balance – October (Marketing Article)

- India’s Overall Trade Deficit deepened to USD 21.8 billion, up sharply from previous month’s USD 16.6 billion, as Merchandise deficit rose by 58% YOY to USD 41.7 billion , from USD 26.2 billion in Oct’24.

- Merchandise exports fell 11.8% to USD 34.4 billion, as Gems and Jewellery exports fell by 29.5% and export of Engineering goods saw a 16.7% decline YoY.

- Services Exports on the other hand held strong, posting a 11.8% growth YoY from USD 34.4 billion in Oct’24 to USD 38.5 billion currently.

- The sharp rise in the merchandise trade deficit is largely driven by an extraordinary 200% surge in gold imports. Taken together, these developments heighten concerns over a widening external imbalance and signal renewed pressure on the rupee, even as domestic fundamentals remain broadly stable.

A widening trade deficit is once again flashing warning signs for India’s external account, mirrored in the persistent depreciation bias of the rupee. The strain is being compounded by Reliance’s pause in discounted Russian crude imports—a shift that threatens to lift energy costs, inflate the import bill, and further weaken India’s trade position.

- India has averaged USD 62 billion a month in merchandise imports across FY25 and FY26 (YTD), making October’s USD 76.1 billion print a sharp 22.7% overshoot. The sharp rise in the merchandise trade deficit is largely driven by an extraordinary 200% surge in gold imports.

- India’s merchandise trade deficit has sharply widened, deepening 58% year-on-year to USD 41.7 billion from USD 26.2 billion last year, as imports surged to USD 76.1 billion while exports lagged at USD 34.4 billion. This growing imbalance underscores the mounting strain on India’s external position, as demand for imports continues to outpace export momentum.

- India has averaged USD 62 billion a month in merchandise imports across FY25 and FY26 (YTD), making October’s USD 76.1 billion print a sharp 22.7% overshoot. The sharp rise in the merchandise trade deficit is largely driven by an extraordinary 200% surge in gold imports.

The primary drivers behind the surge in gold imports come as elevated global gold prices have amplified the value of inbound shipments, while on the other hand, the Reserve Bank of India has continued to build up its gold reserves as part of a broader effort to diversify its asset holdings away from traditional currencies, particularly the Dollar. Together, these forces have pushed the value of gold imports higher, contributing to the expansion of the import bill.

And this is unfolding at a time when the rupee is otherwise supported by robust domestic growth signals and contained inflation, even as the global backdrop, from a hawkish Federal Reserve to tightening liquidity conditions, grows more complex. The real question for markets now is whether India’s trade story can rebalance quickly enough to keep the rupee’s long-term narrative intact.

In conclusion, the rupee’s recent weakness is less a crisis and more a question mark — one reopened by a widening trade gap and a sharp uptick in import demand, particularly for gold and energy. These shifts are not yet destabilising, but they do introduce an unmistakable depreciation bias and invite a closer scrutiny at the strength of India’s external balance account.